Home office tax deduction still available, just not for COVID-displaced employees working from home - Don't Mess With Taxes

Home Office Deduction, Schedule C, Form 1040, Form 8829. How to write off your home office. - YouTube

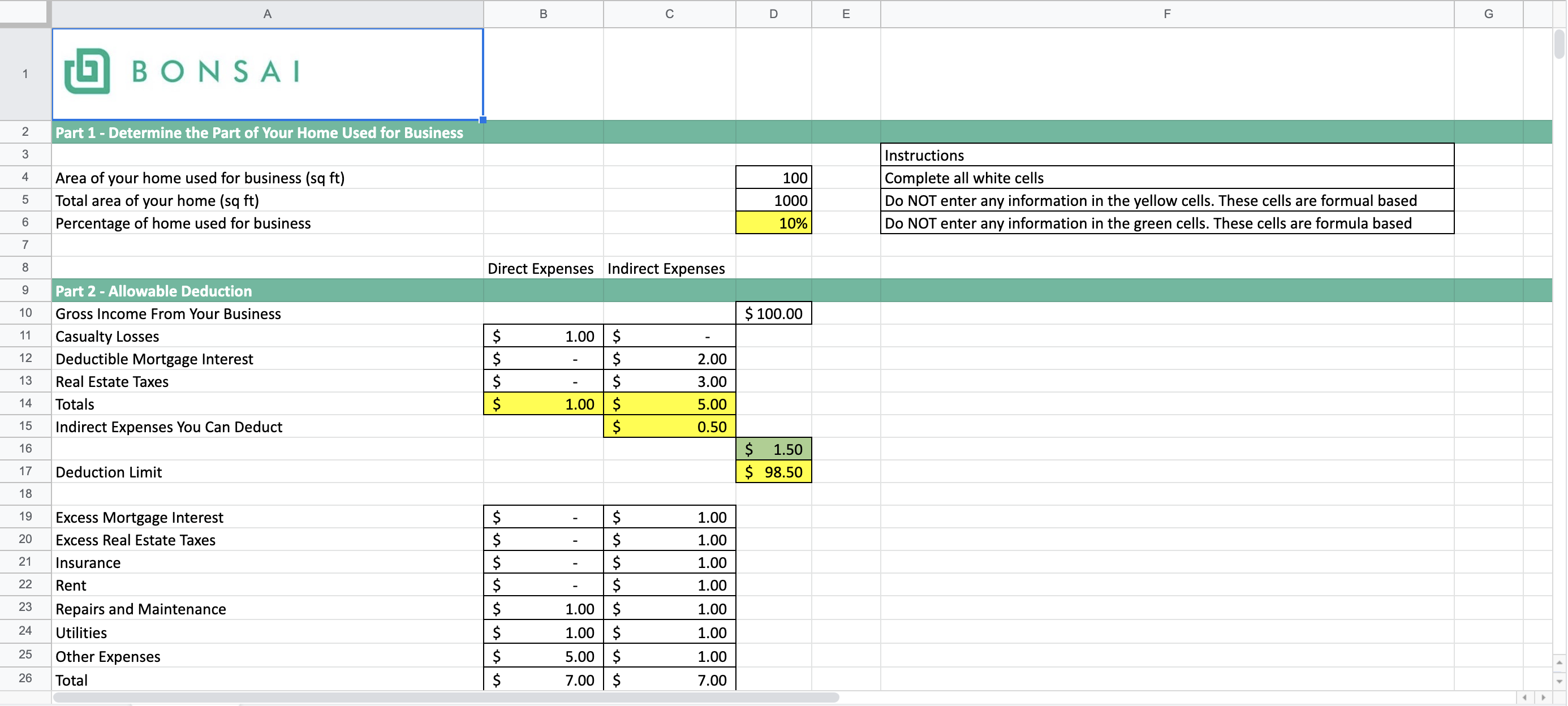

Be sure to claim applicable household utility costs in your home office deduction - Don't Mess With Taxes

:max_bytes(150000):strip_icc()/2022ScheduleAForm1040-e03b04d7ca3e4394b6b6003668f84c6c.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

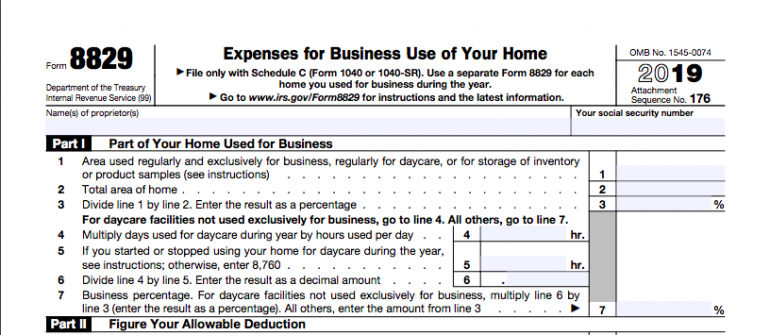

:max_bytes(150000):strip_icc()/IRSForm8829-c4f3b00b5a0f457096b3eb37e88026db.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/pmn/NTK5TE4H6JENBCYLPLEJSN6CNY.jpg)